Empowering 1000+ lenders and fintechs

why adjutor?

Make the best and cost effective decisions

Adjutor was developed to help lenders and fintechs, especially those who have built their independent technologies, to enjoy the data ecosystem and superior services provided by Lendsqr for lenders.

Validate your customers quickly

Access all pertinent customer data in one centralized location, empowering informed decision-making.

Affordable solutions for all

We've handled all the complex integrations with data-centric organizations. Explore affordable solutions at your convenience.

products

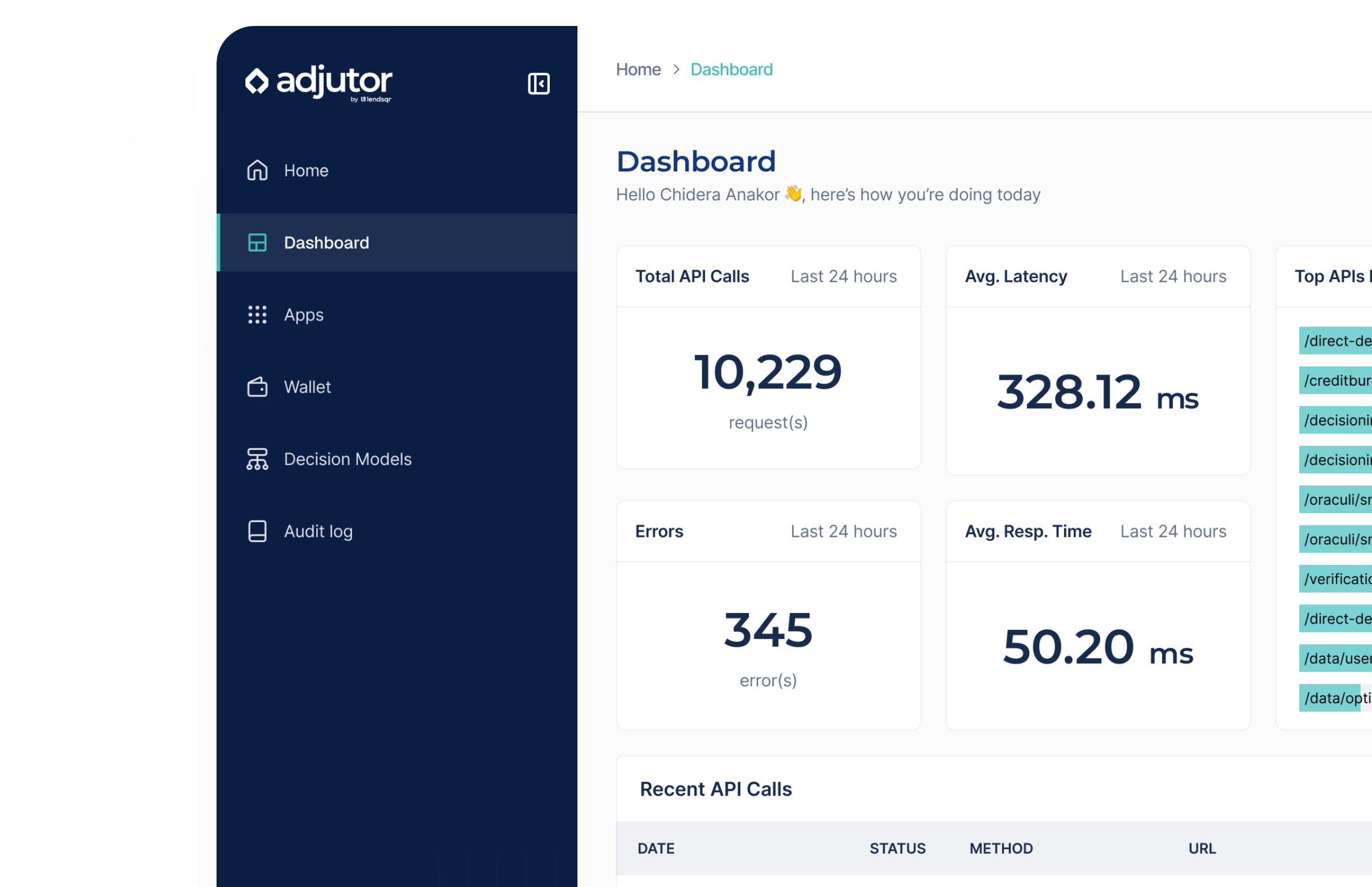

Dynamic APIs to power everything you need to underwrite loans

Choose one or all - Adjutor is everything you need to maximise and scale your lending.

Validation

Quickly validate customers using BVNs, emails, or phone numbers. The validation APIs help you confirm the accuracy of customer information.

Decisioning

Make quick, easy and cost-effective decisions with all the information at your disposal during your loan decision processes.

Credit Bureau

Get accurate credit reports and scores about your users using their BVNs from the top accredited credit bureaus in Nigeria.

Direct Debit

Tokenize access to bank accounts and get one-off or recurring payments using our direct debit APIs. Direct debit mandates are activated in minutes.

Embedded Loans

Power your app with embedded loans or build a highly scalable Buy Now Pay Later loan offerings in few simple clicks.

what you get

Seamless solutions for smart decisions

Affordable data all in one place

Tap into our ecosystem to get data from over 1 million customers.

Extensive data from smartphones

Access a cost effective SDK for Android devices with better APIs and cost that is 1/10 of the next better alternative.

Comprehensive credit reports

Acquire exhaustive reports from credit bureau at a significantly lower cost.

No hits, no charge

We only charge per successful API call, so you don’t need to worry about running out of funds.

Superb lending decisions

Access all pertinent customer data in one centralized location, empowering informed decision-making.

Ease of integration

We have done the stressful integration with these banks and organizations so you don’t have to worry about the technical know-how.